nebraska inheritance tax rates

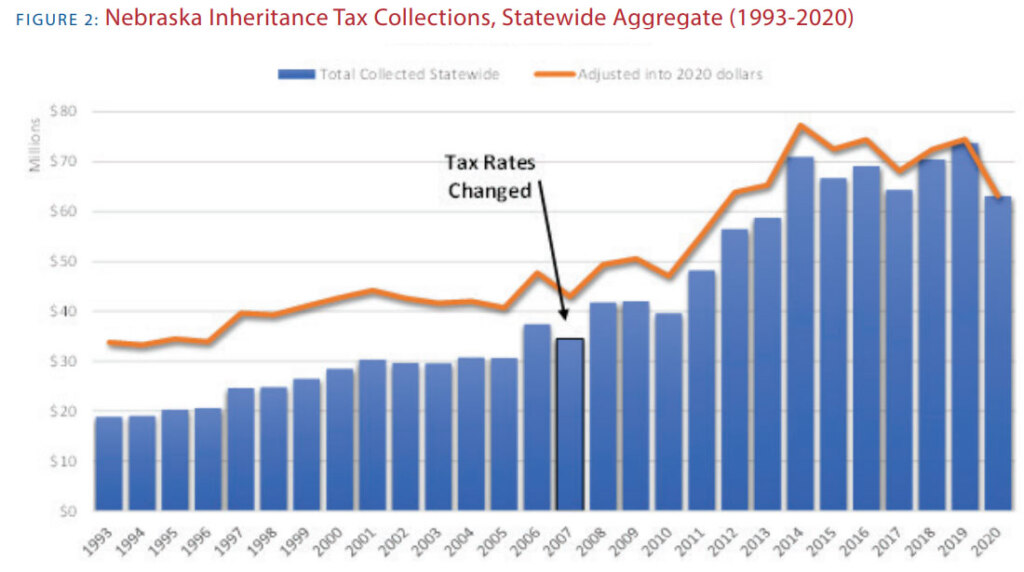

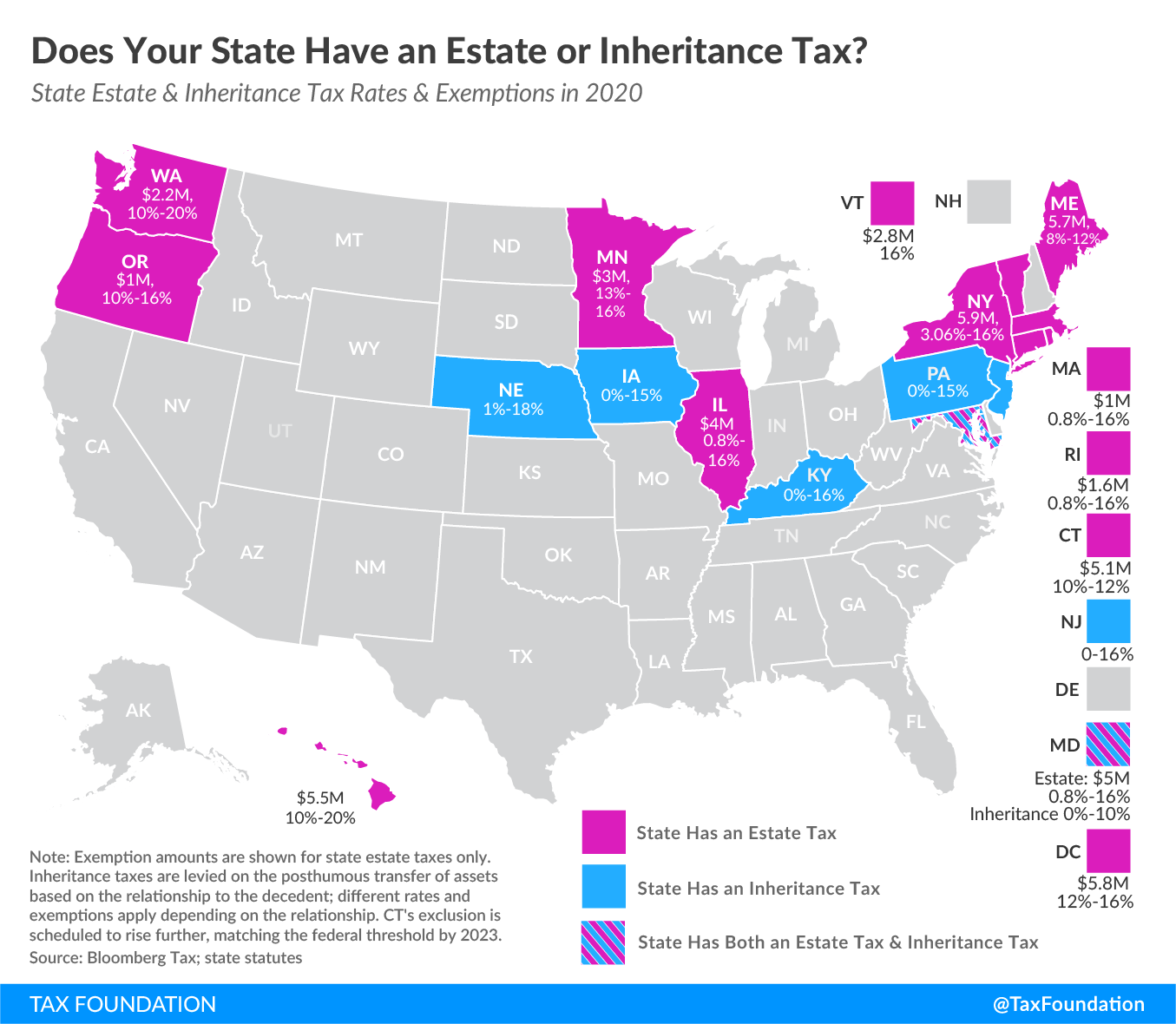

Nebraska Inheritance Tax Exemptions and Rates. Nebraska is currently one of six states that imposes an inheritance tax when a resident of the state passes away.

Death And Taxes Nebraska S Inheritance Tax

00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having.

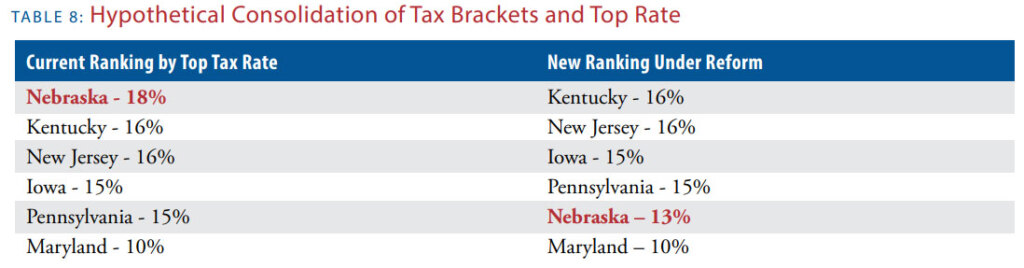

. In fact Nebraska has the highest top rate at 18. 311 99 NW2d 245 1959. For transfers to immediate family members not including.

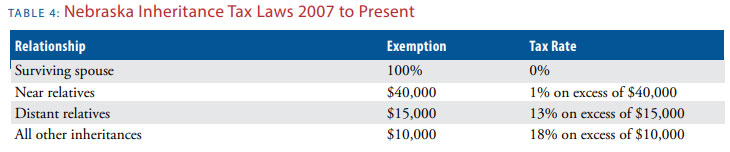

REG-17-001 Scope Application and Valuations. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property not the estate. Anything above 15000 in value is subject to a 13 inheritance tax.

The inheritance tax must be paid within 12 months of the date of death otherwise interest accrues at 14 with penalties of 5 per month up to 25 of the tax due. Nebraska is currently one of six states that imposes an inheritance tax when a resident of the state passes away. Currently the first 15000 of the inheritance is not taxed.

How is this changed by LB310. Nebraska currently has the nations top inheritance tax rate 18 on remote relatives and non-related heirs. The inheritance tax does not currently apply to transfers to a.

Of the six states that currently impose inheritance taxes only two states Nebraska and Pennsylvania have chosen to tax lineal heirs children and grandchildren while the others. Until this TABLE 1. Close relatives pay 1 tax after 40000.

What is inheritance tax do you pay in Nebraska. The exempt amount is. For states to immediately amend their inheritance tax laws into progressive structures and many states that had not yet levied the tax added it to their tax rolls.

How is this changed by LB310. County of Box Butte 169 Neb. For purpose of inheritance.

All taxes imposed by sections 77-2001 to 77-2037 unless otherwise herein provided for shall be due and payable. Surviving spouses are exempt. Currently the first 15000 of the inheritance is not taxed.

An inheritance by the widower of a daughter is not taxable at the rate prescribed by this section. There are only six states in the nation that levy an inheritance tax and Nebraska is one of them. Anything above 15000 in value is subject to a 13 inheritance tax.

Beneficiaries inheriting property pay an inheritance tax over. Nebraska inheritance tax rates If you were the decedents parent grandparent sibling child other lineal descendant or the spouse of one of those people the first 40000. According to a local law firm.

Charitable organizations are usually exempt.

State Estate And Inheritance Taxes Itep

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Death And Taxes Nebraska S Inheritance Tax

The Tax Of Inheritance News Custercountychief Com

Estate Tax Vs Inheritance Tax What S The Big Difference Ageras

Nebraska Inheritance Tax Shaw Hull Navarrette Cpa S P C

Inheritance Tax Cuts Advance Private School Scholarships Debated Nebraska Public Media

Estate And Inheritance Taxes Urban Institute

Death And Taxes Nebraska S Inheritance Tax

How To Calculate Inheritance Tax 12 Steps With Pictures

Inheritance Tax Bill Passes Fairbury Journal News

Inheritance Tax 2022 Casaplorer

Don T Die In Nebraska How The County Inheritance Tax Works

Nebraska Lawmakers Considering Phasing Out High Inheritance Tax But Counties Concerned Khgi

Nebraska Inheritance Tax Updates Erickson Sederstrom

Form 706n Fillable Nebraska Estate Tax Return For Estates Of Persons Who Died On Or After July 1 2003 And Before January 1 2007 6 2007

Bill To Cut Inheritance Tax Rates Increase Exemptions Advanced Unicameral Update